Learning how to fill out a check may seem like a simple task, but for many, it remains confusing in a world dominated by digital payments. Writing checks correctly is essential to avoid mistakes, bounced payments, or fraud.

Despite the rise of online banking, checks are still widely used for rent, utilities, gifts, and business payments. Banks like Chase Bank and others continue to rely on accurate check writing for secure transactions.

This comprehensive 2026 guide will help you master check writing, whether you are a first-time user or need a refresher. You’ll learn:

• How to fill out a check properly and securely

• Step-by-step examples for clarity

• How to write a check for Chase and other banks

• How to fill out a check register to track payments

• How to complete a deposit slip when submitting checks

• Best practices to avoid common errors

Following this guide ensures you handle checks with confidence, minimize mistakes, and maintain proper financial records.

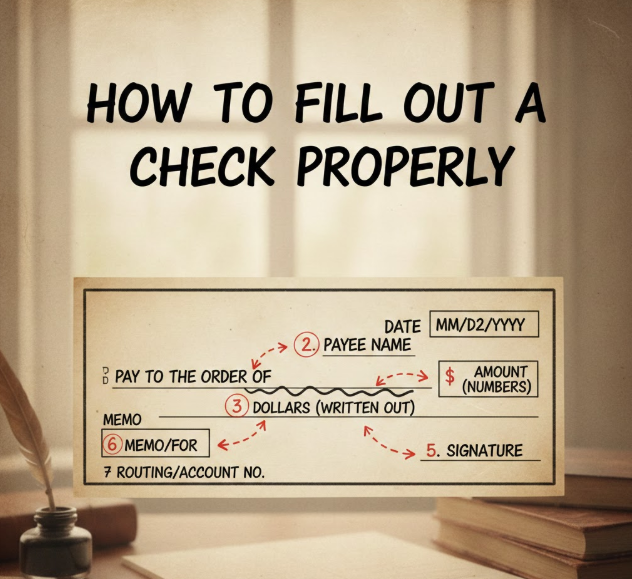

Understanding the Parts of a Check

Before learning how to fill out a check, you need to understand its components. Each part serves a specific purpose in ensuring payment is correctly processed.

Key Components of a Check

• Date Line

The date specifies when the check is written. This is crucial for tracking and legal purposes. Postdating checks can be used for future payments.

• Payee Line

This line states the individual or business receiving the money. Accuracy is essential to prevent the check from being cashed by the wrong person.

• Dollar Box

The numerical amount of the payment is written here. It must match the written amount to avoid processing errors.

• Amount in Words Line

The same amount is written in words. Banks prioritize this line if discrepancies arise.

• Memo Line

Optional but useful for recording the purpose of the payment. It can help with personal or business accounting.

• Signature Line

Your signature authorizes the payment. Always sign consistently with your bank records to avoid rejections.

Also Read:- How to Make Ice Cream: The Ultimate Guide for Beginners & Experts

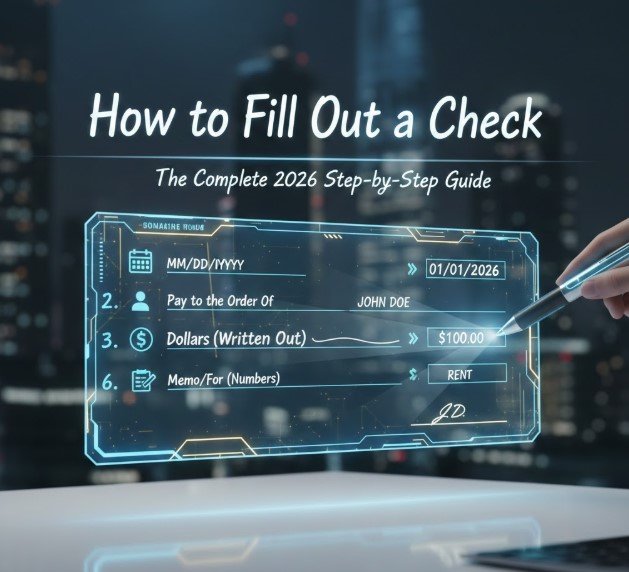

How to Fill Out a Check Properly

Filling out a check properly ensures smooth transactions and reduces the risk of errors or fraud.

Step-by-Step Proper Filling Techniques

• Start With the Date

Write the current date in the top-right corner. Use standard formats like MM/DD/YYYY for clarity.

• Enter Payee Name Correctly

Write the full name of the person or business. Avoid abbreviations that could lead to confusion.

• Write Dollar Amount Numerically

Enter the amount in the small box using numbers. Ensure decimal points and cents are clear.

• Spell Out the Amount

Write the amount in words on the line below the payee name. Include cents as a fraction, e.g., “75/100.”

• Add a Memo (Optional)

Include the purpose of the check, like “Rent for March” or “Invoice #1234.” This helps you track transactions.

• Sign the Check

Complete the check by signing on the bottom right. Use the same signature your bank has on file.

Also Read:- How to Make Tea: The Complete Guide for Beginners and Connoisseurs

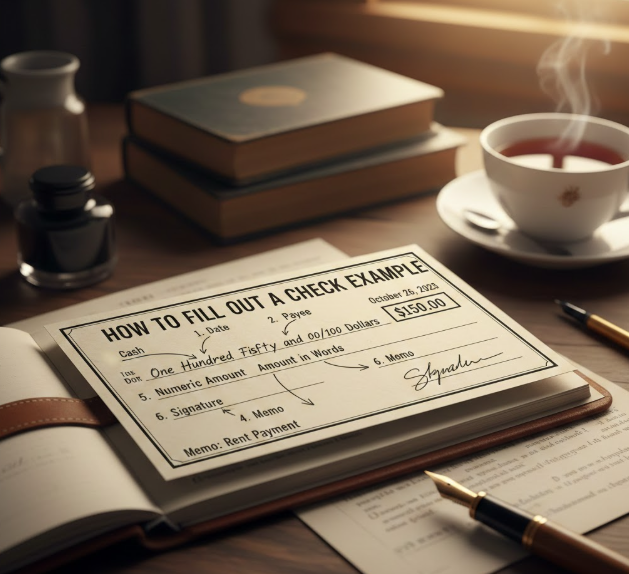

How to Fill Out a Check Example

Examples make learning easier. Here’s a practical demonstration of how to fill out a check.

Example Breakdown

• Date: 02/16/2026

• Payee: John Doe

• Numeric Amount: $150.75

• Written Amount: One hundred fifty and 75/100 dollars

• Memo: Birthday Gift

• Signature: Jane Smith

This clear format ensures the check is processed without delays. Following examples like this reduces mistakes for beginners.

Also Read:- How to Cut Your Own Hair: A Complete Guide for Beginners

How to Fill Out a Check Chase

If you bank with Chase Bank, the process is similar but has some specific tips to avoid errors.

Chase Check Filling Tips

• Use Ink, Not Pencil

Chase requires permanent ink to process checks reliably.

• Align Amounts Properly

Ensure numeric and written amounts match. Chase scanners prioritize the numeric box.

• Include Payee Information

Full legal name ensures the check clears without issue.

• Avoid Blank Spaces

Fill in all lines; leave no room for alterations.

• Date Correctly

Use current date; postdated checks may be refused.

• Sign Consistently

Use your verified signature as recorded with Chase to avoid rejections.

Also Read:- How to Open a Can Without a Can Opener: The Ultimate Guide

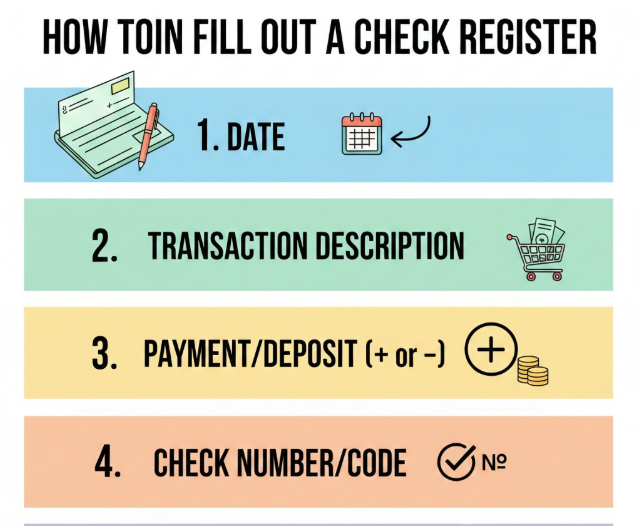

How to Fill Out a Check Register

A check register helps track transactions and avoid overdrafts.

Check Register Guidelines

• Record Check Number

Every check has a unique number. Track it in your register.

• Enter Date

Write the date the check was written for clarity.

• Write Payee Name

Track to whom the payment was made.

• Enter Amount

Debit the register with the check amount to reflect your balance accurately.

• Update Balance

Subtract the check amount from previous balance to maintain current account info.

• Include Notes

Memo or purpose can help for accounting and tax purposes.

Also Read:- How to Bake a Cake: The Ultimate Step-by-Step Guide for Perfect Results Every Time

How to Fill Out a Check Deposit Slip

Depositing checks requires a deposit slip, ensuring banks credit your account correctly.

Step-by-Step Deposit Slip Instructions

• Write Your Name

Include account holder’s name at the top.

• List Your Account Number

Ensure deposits are credited to the correct account.

• Enter Check Details

Include each check amount and total.

• Sign the Slip

Signature authorizes the deposit.

• Include Cash if Any

Add any cash you’re depositing along with checks.

• Keep a Copy for Records

Maintain a duplicate for accounting and tracking.

Also Read:- How to Fix a Zipper: The Complete Guide for Every Clothing and Bag Issue

Conclusion

Learning how to fill out a check properly is essential for personal and business financial management. Correctly writing dates, payee names, numeric and written amounts, and signing ensures smooth transactions and minimizes errors.

Using check registers and deposit slips further ensures accuracy, accountability, and record-keeping. Following this 2026 guide ensures confidence in every check you write.

FAQs

Can I fill out a check online?

Yes, some banks offer digital checks, but manual checks are still widely accepted.

What if I make a mistake on a check?

Void the check and write a new one; never erase or overwrite.

Do I need to sign every check?

Yes, your signature authorizes the payment and ensures processing.

How do I track checks I’ve written?

Use a check register or online banking transaction history.

Can I deposit someone else’s check?

Yes, but endorse it properly on the back with your signature.

For More Visit Alaikas.com